social security tax rate

All tax filers pay the bottom rate on the portion of their income up to 41050 for married couples and. In 2021 the Social Security tax rate is 124 divided evenly between employers and employees on a maximum wage base of 142800.

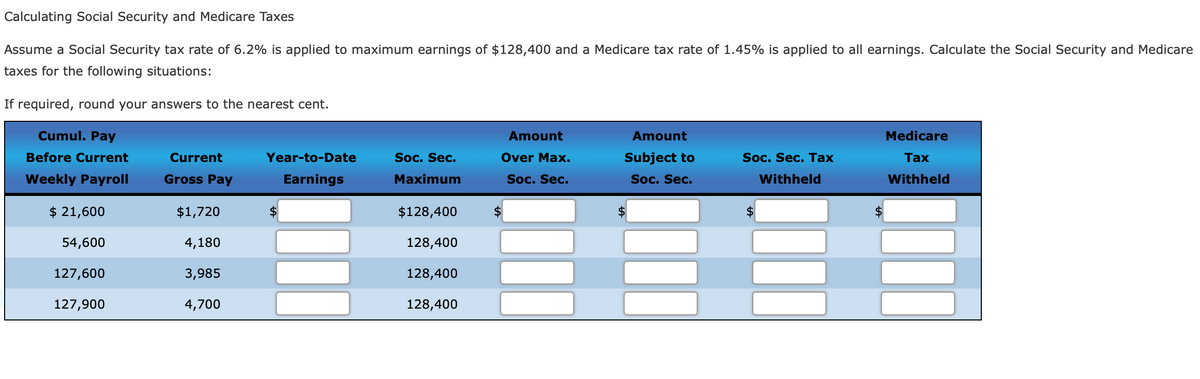

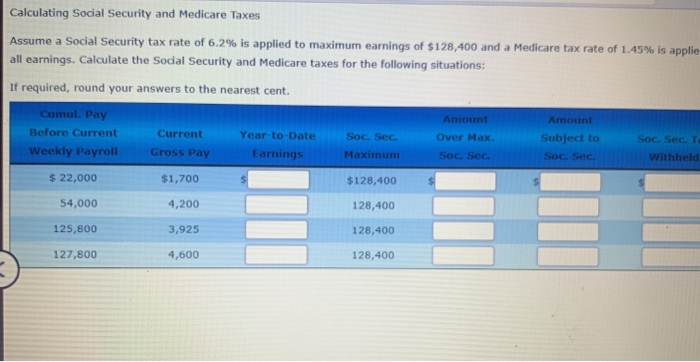

Answered Calculating Social Security And Bartleby

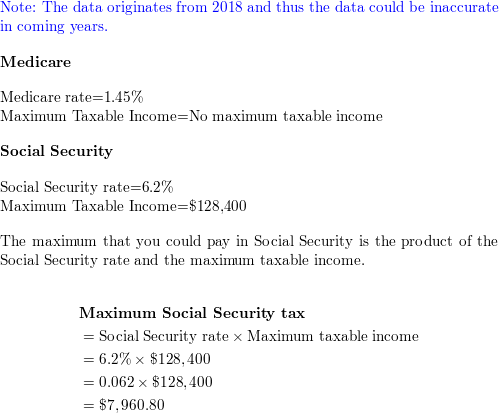

In 2020 employees were required to pay a 62 Social Security tax on income of up to 137700.

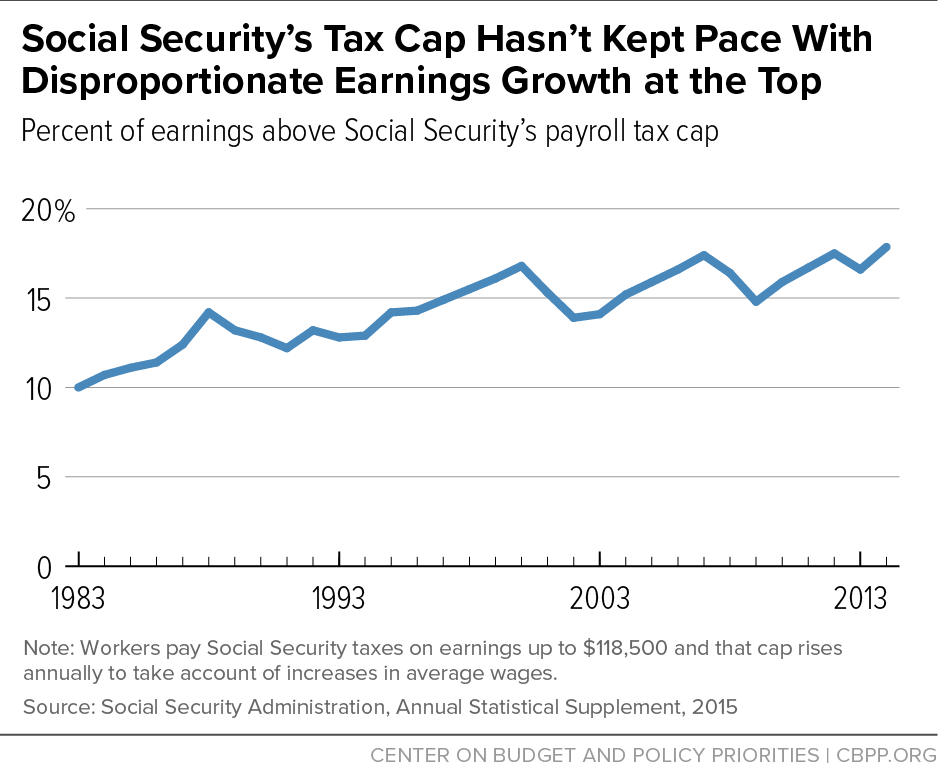

. Robert Reich former United States Secretary of Labor suggests lifting the ceiling on income subject to Social Security taxes which is 142800 as of 2021. The Social Security tax rates are set by law and the proceeds are. Maximum Taxable Earnings Rose To 142800.

The Social Security tax rate for both employees and employers is 62 of employee compensation for a total of 124. Self-employed individuals pay the. If the 15000 was not taken off tax-free and the assessment rate did not change the math would be 550000 multiplied by 695 for a taxable value of 38225.

Any earnings above that. The Social Security tax rate for those who are. Nearly everyone who earns an income is subject to taxes based on the current Social Security tax rate.

The current rate for Medicare is 145 for the employer and 145. Increase Social Security taxes. Up to 85 of a taxpayers benefits may be taxable if they are.

The states bottom income tax bracket will be cut from 535 to 510. Filing single head of household or qualifying widow or widower with more than 34000 income. 35 rows For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security.

More than 44000 up to 85 percent of your benefits may be taxable. The OASDI tax rate for wages paid in 2022 is set by statute at 62 for employees and employers so an individual with wages equal to or larger than 147000 would contribute. As of 2021 that amount increased to 65 percent and in 2022 the benefits.

Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

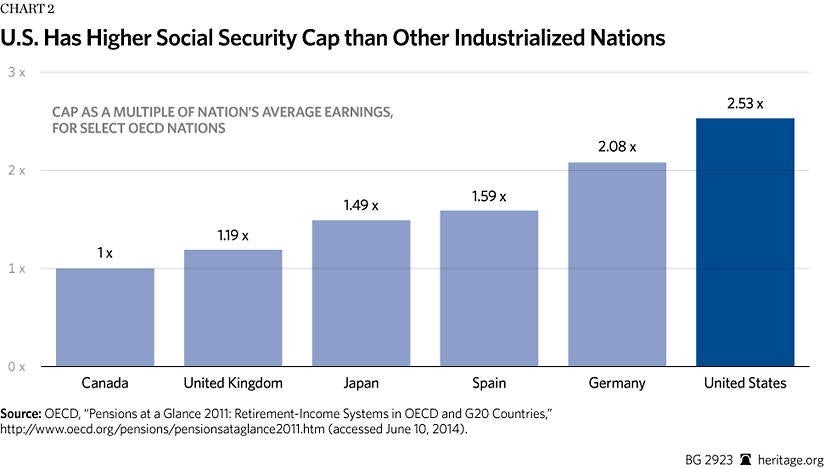

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

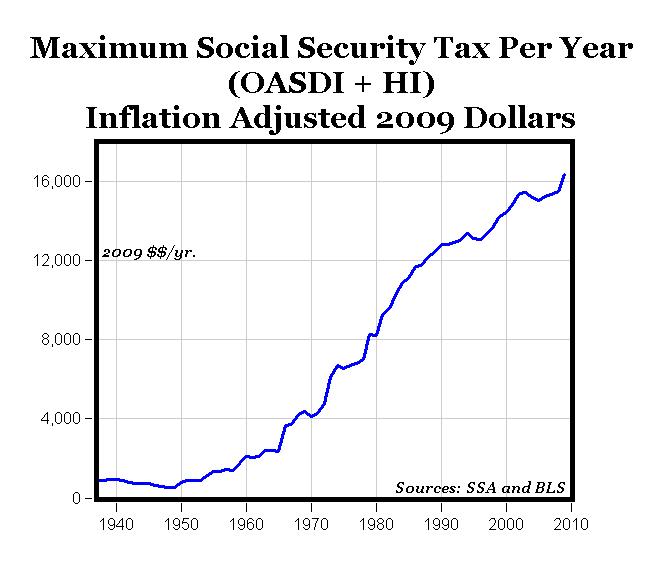

Maximum Social Security Taxes 4x Increase Since 1970 Seeking Alpha

Is Social Security Taxable 2022 Update Smartasset

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

How Avoiding Fica Taxes Lowers Social Security Benefits

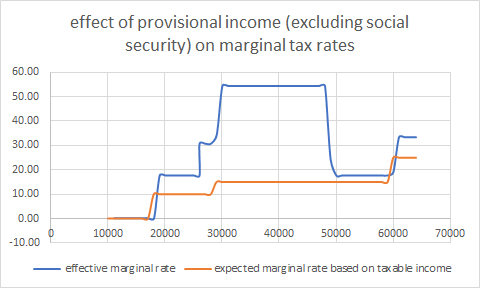

Taxation Of Social Security The Tax Torpedo Roth Conversion Tightrope Early Retirement Now

Opinion Brave But Flawed Idea To Save Social Security

The Tax Bubble Of Social Security Can Be Dramatic Income For Life

Solved Calculating Social Security And Medicare Taxes Assume Chegg Com

How Social Security Gets Fixed Matters Squared Away Blog

Social Security Wage Base Increases To 142 800 For 2021

The Evolution Of Social Security S Taxable Maximum

Experiment 2 Total And Combined Social Security Tax Rates And Labor Download Scientific Diagram

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

Research Income Taxes On Social Security Benefits

Find The Social Security And Medicare Tax Rates For The Curr Quizlet

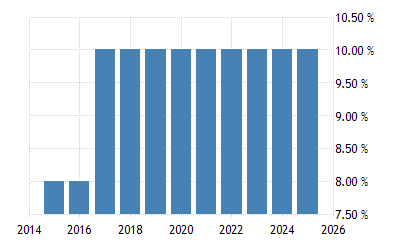

Colombia Social Security Rate For Employees 2022 Data 2023 Forecast